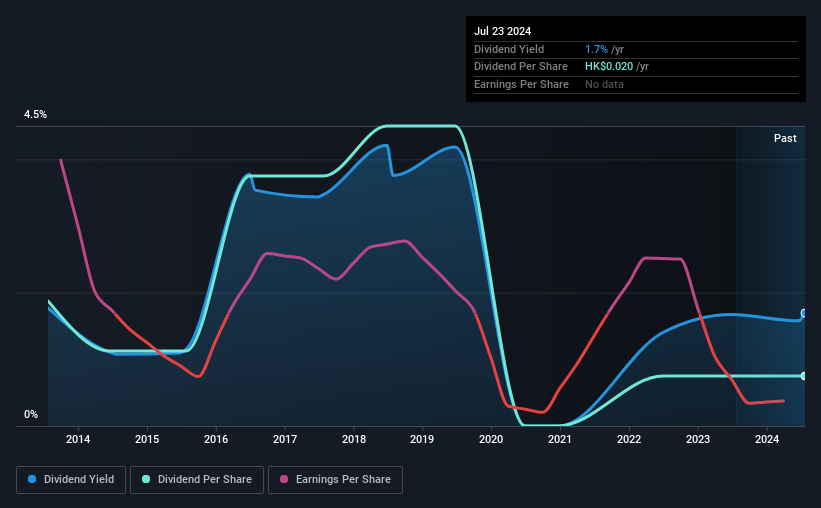

Yangtzekiang Garment Restricted (HKG:294) has introduced that it’ll pay a dividend of HK$0.02 per share on the twenty third of October. The dividend yield is 1.7% based mostly on this fee, which is a bit bit low in comparison with the opposite corporations within the trade.

See our newest evaluation for Yangtzekiang Garment

Yangtzekiang Garment May Discover It Laborious To Proceed The Dividend

Whether it is predictable over an extended interval, even low dividend yields may be enticing. Whereas Yangtzekiang Garment will not be worthwhile, it’s paying out lower than 75% of its free money move, which suggests that there’s loads left over for reinvestment into the enterprise. We usually suppose that money move is extra necessary than accounting measures of revenue, so we’re pretty comfy with the dividend at this degree.

Current, EPS has fallen by 10.5%, so this might proceed over the subsequent yr. This implies the corporate will not be turning a revenue, which may place managers within the powerful spot of getting to decide on between suspending the dividend or placing extra strain on the stability sheet.

Dividend Volatility

The corporate has an extended dividend observe document, nevertheless it does not look nice with cuts previously. The dividend has gone from an annual complete of HK$0.05 in 2014 to the latest complete annual fee of HK$0.02. This works out to be a decline of roughly 8.8% per yr over that point. An organization that decreases its dividend over time usually is not what we’re on the lookout for.

Dividend Progress Potential Is Shaky

Dividends have been going within the flawed path, so we positively need to see a special development within the earnings per share. Yangtzekiang Garment’s EPS has fallen by roughly 11% per yr through the previous 5 years. Dividend funds are prone to come beneath some strain until EPS can pull out of the nosedive it’s in.

Yangtzekiang Garment’s Dividend Would not Look Sustainable

In abstract, whereas it is good to see that the dividend hasn’t been lower, we’re a bit cautious about Yangtzekiang Garment’s funds, as there could possibly be some points with sustaining them into the longer term. The funds have not been notably steady and we do not see large progress potential, however with the dividend properly lined by money flows it may show to be dependable over the brief time period. We do not suppose Yangtzekiang Garment is a good inventory so as to add to your portfolio if revenue is your focus.

Traders have a tendency to favour corporations with a constant, steady dividend coverage versus these working an irregular one. Nonetheless, traders want to think about a bunch of different elements, aside from dividend funds, when analysing an organization. For instance, we have recognized 2 warning indicators for Yangtzekiang Garment (1 is a bit regarding!) that you ought to be conscious of earlier than investing. On the lookout for extra high-yielding dividend concepts? Attempt our assortment of robust dividend payers.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Yangtzekiang Garment is probably over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved in regards to the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to deliver you long-term centered evaluation pushed by basic knowledge. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Yangtzekiang Garment is probably over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved in regards to the content material? Get in contact with us straight. Alternatively, e-mail [email protected]